Submitted by Rob Hertert, Host2Host President, co-creator of Hosting Your Home podcast and host in SW Portland and the Oregon Coast.

Our June, 2021 meetup was hosted by the Host2Host Advocacy committee. Committee speakers were Robert Jordan, chair/MC, and Melissa Wright, committee member and owner of STR Permit. City speakers included Scott Karter and Craig Doherty from Revenue Division and Mike Johnson from the Portland Housing Bureau.

Thank you Airbnb for helping to promote this event.

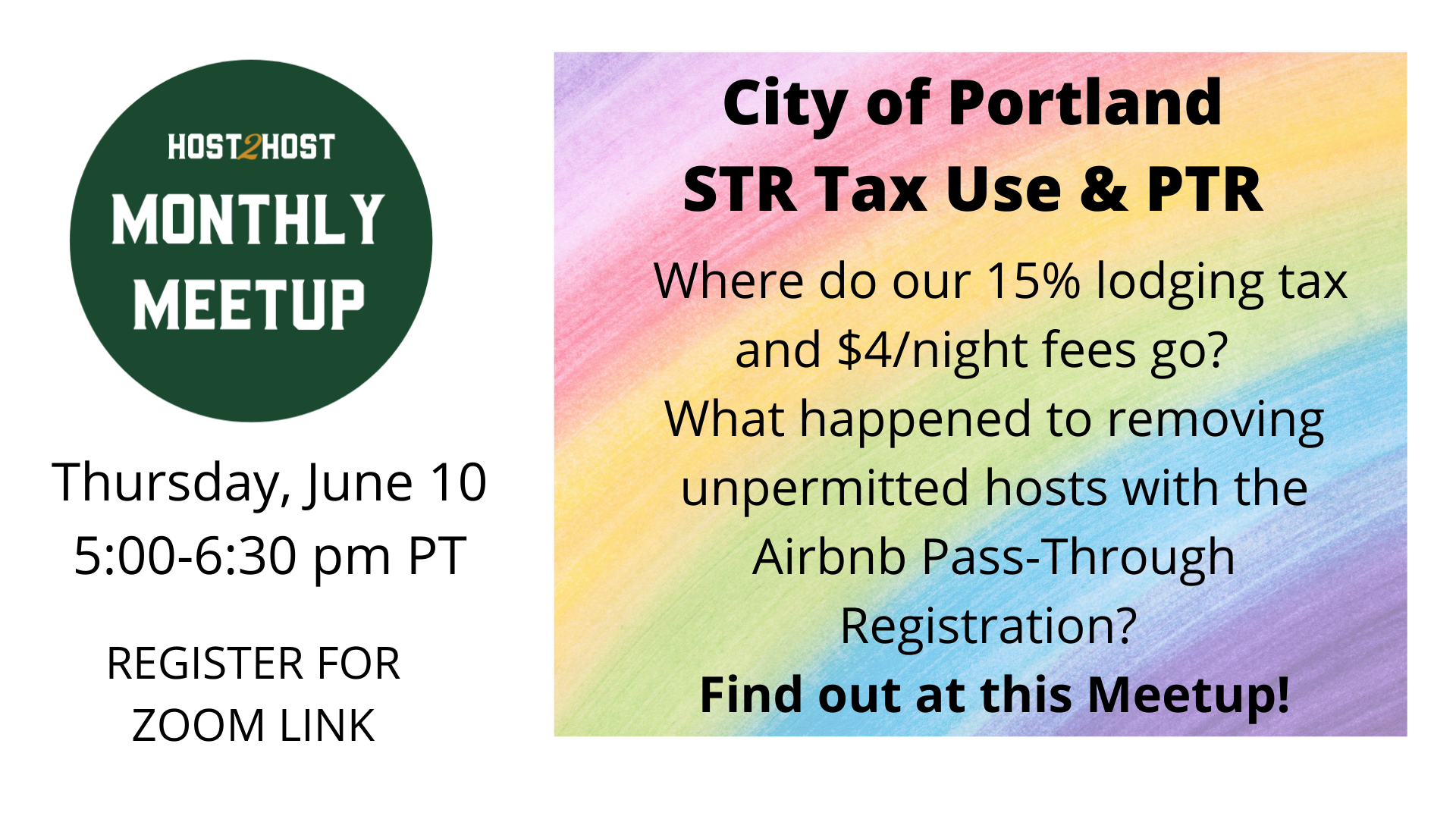

The purpose for the meetup was to hear more about where our guests’ STR taxes and fees are used, learn about the Housing Bureau and what impact our funding stream has, and get an update on Airbnb’s Pass Through Registration.

Robert Jordan gave an overview of the Advocacy committee’s audiences: Government officials, STR platforms, and neighbors and our greater communities. He touched on some major work including providing organized testimony at City Council, assisting Revenue with a review of their draft Pass Through Registration ordinance, sponsoring a City Council candidate forum, and inviting city officials to speak at events such as this one.

Taxes: Scott Karter of Portland’s Revenue Division gave us a chronological tax review:

2015: Scott told us that in 2015, not that long after STRs were legalized, City Council directed that most of the STR taxes should go to the Housing Investment Fund (HIF). At that time, STR guests were paying 6% to Portland (including 1% that passes through to Travel Portland), 5.5% to Multnomah County, and 1.5% to Travel Oregon. Council redirected 5% of STR’s “TLT”, or Transient Lodging Taxes to the HIF. Total STR taxes: 13%.

2018: Many Host2Host members will recall the Council Hearing in which STRs and small hotels would now pay an additional 2% Tourism Improvement District “TID” tax to Travel Portland, matching the large hotel taxes. In addition, a $4/night fee per booking would be assessed on only STRs. The $4/night fee would again be directed to the Housing Investment Fund. ( ed. note: an important consolation was made, giving Host2Host a seat on Travel Portland’s board of directors). Total STR taxes and fees: 15% + $4/night.

2021: To climb out of the tourism collapse and to help fund reputation recovery, an additional 1% TID tax was levied on all hotels and STRs. Total STR taxes and fees: 16% + $4/night.

These taxes and fees are summarized here.

Housing Investment Fund: Mike Johnson told us that the Portland Housing Bureau provides pass-through funding for all types of affordable housing in the City. The Bureau has a wide range of funding beyond the STR taxes and fees including $500 million in bonds and grants being targeted for 2,000 units between two bonds. But the STR revenue stream supplements the bonds and grants. Mike said that pre-Covid the $4/night fees alone were over $2 million per year.

An example of a Housing Fund action is the recent acquisition of 263 units of affordable housing. Some associated expenses aren’t allowed to be paid for with bonds, making the STR tax and fee revenue especially valuable. TLT will be used for affordable housing targeting residents who have an income of less than 60% of Portland’s median income of $80,000. The $4/night revenue provided over $2 million for rent assistance to the Joint Office of Homeless Services.

In 2022, the $4/night fees will help BIPOC commitments for down payment assistance, allowing first time homeowners to buy. The fees replaced the prior source of funding of this important program. View Mike’s slides here.

Pass-Through Registration: Melissa Wright told us that prior to January, 2020 the City knew those hosts who were permitted but couldn’t identify those who were not. It wasn’t possible to enforce the permitting program.

Through a legal settlement between the City and the platforms the Short Term Rental Registry was formed. No platform may advertise (post a listing) for any host who’s name and address don’t show up in this Registry.

Airbnb’s solution to getting a host in the Registry was their Pass Through Registration program (PTR). The computer interface between the City and Airbnb is not yet functional but the process is in place, whether it’s by paper or electronic. Melissa shared the details of that process with meetup participants through this set of slides. Contact Melissa at STR Permit for more information.

Q&A included dealing with the bad reputation of the city, allowable use of STR funds, whether there is an ongoing building maintenance fund for affordable housing projects, criticism about building too nice of buildings, and more.

Robert Jordan wrapped up with a note about the regressive nature of the $4/night fee. We’re seeing the effects of the fee as being positive for the affordable housing, but regressive for the host with low rental rates. A conversion to an equivalent percentage would be better for hosts.

Host2Host dues-paying members can view the meetup recording here.